Should you buy property as Turkish currency drops

2014-01-27 12:27:58

Then came Turkey's own little political problems with the Gezi Park events in June and before these subsided came the corruption claims against some of Premier Erdogan's ministers. In addition, Turks will go to the polls in March 2014 for local elections, where opinion polls suggest that the ruling AK Party is expected to lose some prominent regions, possibly including greater Istanbul to CHP's Mustafa Sarigul.

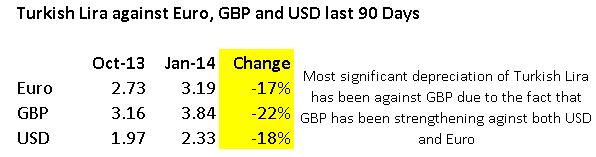

External factors mainly to do with actions of the US Federal Reserve now coupled with internal frustrations within the government have since October caused a significant slide in the Turkish currency against hard currencies. The corruption claims, which have now eased up internally, seem to have been the icing on the cake on Turkish Lira's downward spiral in the international markets.

The question we get asked the most is 'should we buy property now that Turkish currency has dropped?'.

Naturally overseas home buyers as well as real estate investors are looking at ways and means of capitalising on the slide of Turkish currency. Perception among some buyers is that since Turkish Lira has depreciated significantly against Euro, GBP and USD in particular, then there Turkish property prices should be going down. So, in terms of Euro, GBP or USD, it should cost less to buy properties in Turkey. However, is this really the case? Let us have a look.

Most properties along the Aegean and Mediterranean coasts of Turkey, where foreign nationals favour, are quoted in Euro or USD, even in GBP in some areas such as Kalkan and Fethiye, where majority of overseas buyers are British. Having said that property developers tend to take into account their build costs and land prices in arriving at asking prices. So, the question is - what happens to their costs when Turkish Lira weakens against USD in particular, then Euro. Great majority of Turkish construction sector imports are invoiced in USD and Euro. These include, iron, steel, petrol & diesel and some other construction materials. The one single element of construction that is not affected by changes in currency is labour and we all know that Turkish construction industry is more labour intensive than say the UK. However, how much more?

Of these cost drivers the only one that is unaffected by the currency fluctuations (in the medium term anyway) is labour. Almost all other cost variants have some link to imports and foreign currency.

Iron and steel in particular, which is the next largest chunk of cost, is almost entirely invoiced in USD. Therefore as Turkish Lira weakens, these costs become more expensive for Turkish builders.

If we were to try to segregate costs that are Lira linked (such as labour) and those that are foreign currency driven, you are almost at a 50/50 split. This means as Lira weakens developers’ costs increase. Since October 2013, Turkish builders association has reported on average 15% increase in construction costs. In other words, it now costs 15% more to build a house in Turkey as it did 6 months ago.

Considering that up to 65% of all properties bought in Turkey by foreign nationals are new build properties sold by developers and builders, then it is not realistic to expect an equivalent decrease in the prices of these properties in line with Turkish Lira's loss of value against Euro, GBP and USD. However, does this mean there are no deals to be had? Are there no ways in which foreign buyers can turn the weakening of Turkish Lira to their advantage? Of course there are..

How can you turn weak Turkish Lira to our advantage as foreign buyers?

As we have covered above, we can't expect builders to reduce their prices in line with currency changes. This is not realistic because their cost base has increased. However, as illustrated above, their cost base has not increased quite as much due to labour and some other cost elements being in Turkish currency. Therefore, if you are a Brit buying a holiday home in Turkey and your currency has now appreciated against Turkish Lira by some 22% since October, it is fair to expect half of this to pass to you with the builder still maintaining his margin.

Then should you expect to see properties marked down on web sites by up to 10-15% or even more to tempt buyers? The answer is 'NO'. Properties will not be marked down because in popular regions they are quoted in Euro or GBP or USD to start with. Turkish developers will not go back to their prices and devalue them. However, what we are seeing is an increased power to negotiate. We have managed to secure around 10% off the asking prices for our clients attributable to currency, and as you can see the argument above is solid, so a reasonable developer should not be arguing against it. We tend to use this to its maximum during negotiation stage.

What about resale properties sold by individuals and not by developers? Aren't there bigger savings to be had there?

Example of a private sale in Fethiye Ovacik recent reduced - this is a beautiful detached house on 1,000sqm private land - the property was on the market at a much deserved price tag of GBP 180,000 late last year. We have now reduced it to GBP 149,000, which is a 17% price reduction. Sellers are Turkish Lira focused thus unlike commercial developers they don't have escalating costs invoiced in USD or Euro. Please do not hesitate to contact us for a list of similar offers.

In the case of private sellers you’re more likely to see actual price reductions. We have already reduced the prices of some of our private listings in the last 2 months or so, some by up to 15%. So, yes that has already happened and prices have already been adjusted to reflect the fact that £1 is now 22% more TL and 1 Euro is 17% more.

Final analysis - Is it a good time to buy in Turkey now?

If you are looking for the best deals you can get, then yes it is very good time to go property shopping right now and leading up to Turkish elections in March 2014. Within the proceeding few months of elections, we expect the internal factors, which partially gave rise to the currency slide, to start reversing themselves. This will undoubtedly have a positive impact on Turkish currency again. Therefore expect Turkish Lira to start picking up from around April 2014 onwards. So, the best window of opportunity to invest in a home in Turkey seems to be the less-sunny winter months leading up to just after the elections, in other words the next 60 days or so.